R&D Isn’t Just for Scientists – It’s Fuel for Software Innovation

For many Australian software companies, innovation is at the core of what we do – whether it’s developing new platforms, integrating AI-driven solutions, or creating seamless digital experiences. But innovation requires investment, and that’s where R&D grants can be a game-changer.

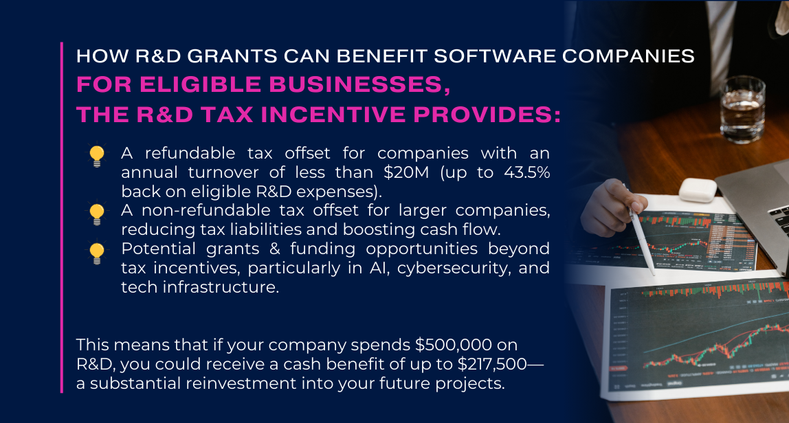

The Australian R&D Tax Incentive (RDTI) is designed to encourage businesses to invest in R&D by offsetting some of the costs associated with innovative development. However, many software companies either overlook it or struggle with eligibility and compliance.

Are You Leaving Money on the Table?

Despite being one of Australia’s largest growth sectors, the software industry faces unique challenges in securing R&D grants. Many companies assume they don’t qualify because:

- They’re “just” developing software – But R&D isn’t limited to scientific labs. Software companies working on new algorithms, AI applications, or novel integrations may qualify.

- The process seems too complex – Understanding eligibility, documentation, and compliance can be daunting, but structured planning makes a difference.

- They believe only large enterprises can claim – Small to mid-sized businesses can benefit significantly, especially startups driving new tech innovations.

If you’re investing time, money, and expertise into solving technical challenges that go beyond routine software development, you could be eligible for R&D incentives.

What Qualifies as R&D in Software Development?

Not every software project is eligible, but if you’re working on:

- Developing new algorithms or AI-driven features that go beyond common applications.

- Pushing the boundaries of cloud computing, cybersecurity, or blockchain technology.

- Overcoming technical uncertainty – solving a problem where no existing solution is readily available.

- Advancing software engineering methods – such as automation, machine learning integration, or performance optimization beyond industry standards.

If you’re facing significant technical challenges in achieving these goals, there’s a strong case for R&D eligibility.

How to Maximise Your R&D Claim

- Identify & Document R&D Activities – Clearly differentiate routine development from genuine innovation.

- Track Eligible Expenses – Labour costs, cloud computing, software tools, and contractor fees may be claimable.

- Seek Expert Guidance – Work with R&D specialists who understand software development to ensure compliance and maximise your claim.

- File on Time – The deadline for R&D claims is 10 months after the end of your company’s financial year. Missing this could cost you thousands in lost benefits.

Final Thoughts: Are You Ready to Claim?

If you’re a software company that’s investing in innovation, R&D grants can provide significant financial relief, allowing you to:

- Scale faster with reinvested funds.

- Hire and retain top talent with increased cash flow.

- Drive Australia’s tech sector forward through continuous innovation.

At FlexiDev, we know firsthand how valuable R&D incentives can be in fueling software innovation. If you’re unsure whether your projects qualify, now is the time to start the conversation.